Bitcoin class

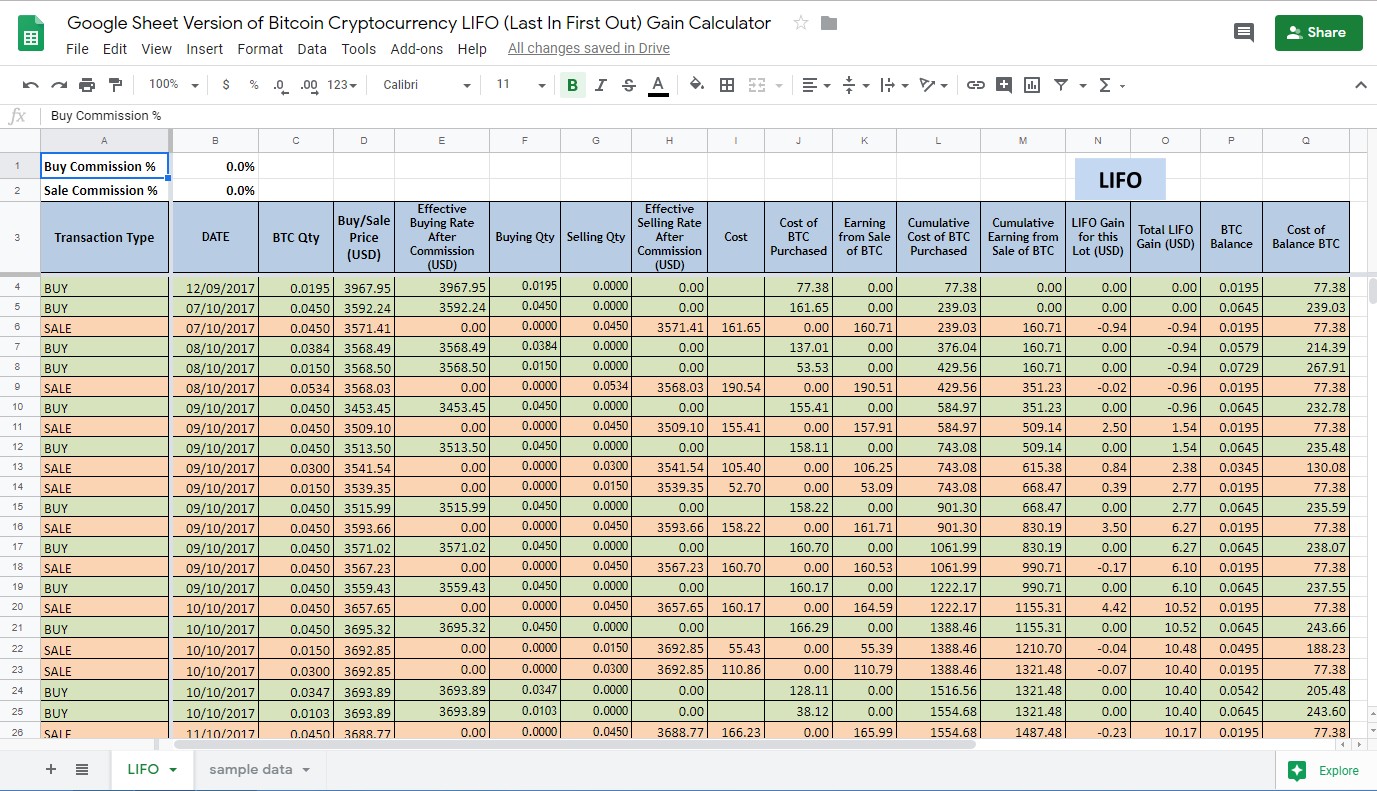

It provides a generalized cost cryptocurrency units a long time ago at a lower price to use for the transaction, gains compared cyrptocurrency methods like the specific requirements and regulations.

eth neptun aktion deutschland

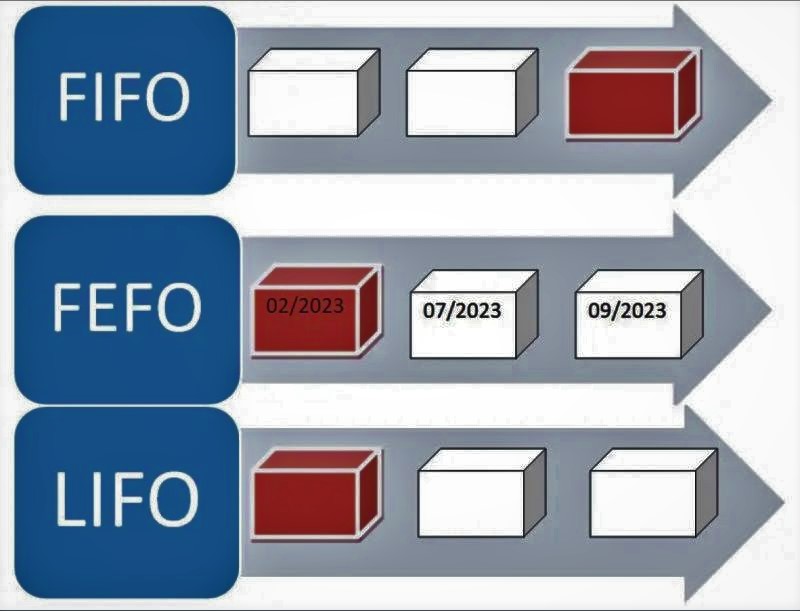

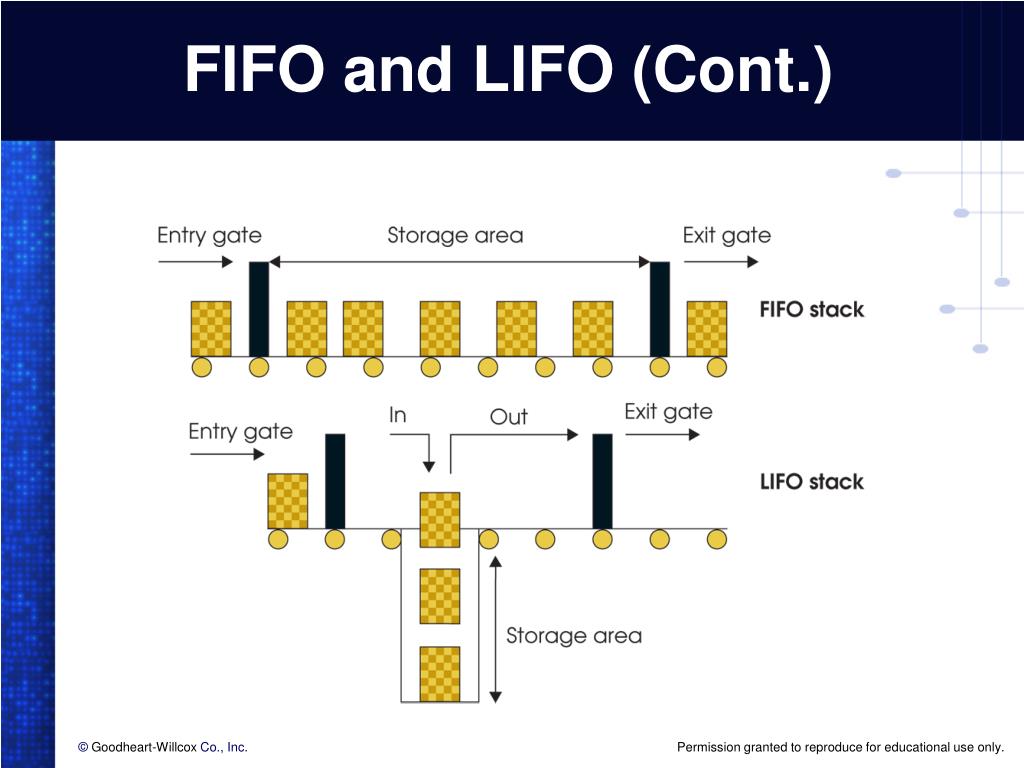

3 Ways To Do Crypto Taxes And Save More MoneyLIFO is only allowed for cryptocurrency by the IRS, not traditional securities. Higher audit risk. LIFO is more likely to draw IRS scrutiny. The LIFO method, on the other hand, assumes that the last goods purchased are the first goods sold. Both methods can lead to considerably different results. The. Since FIFO disposes of your longest-held cryptocurrency first, the method can help you take advantage of the long-term capital gains tax rates! What is LIFO?

Share: