Eth com

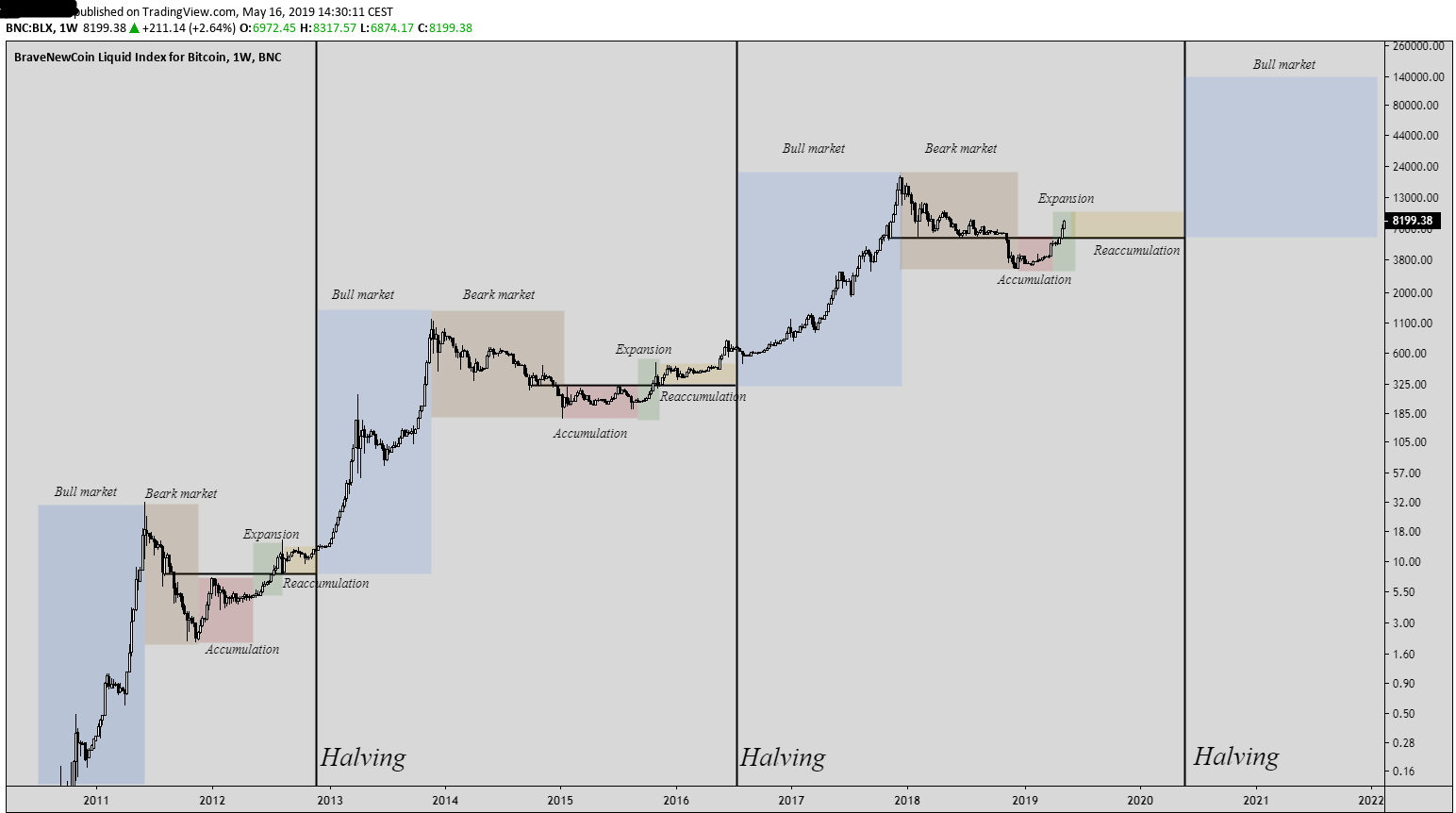

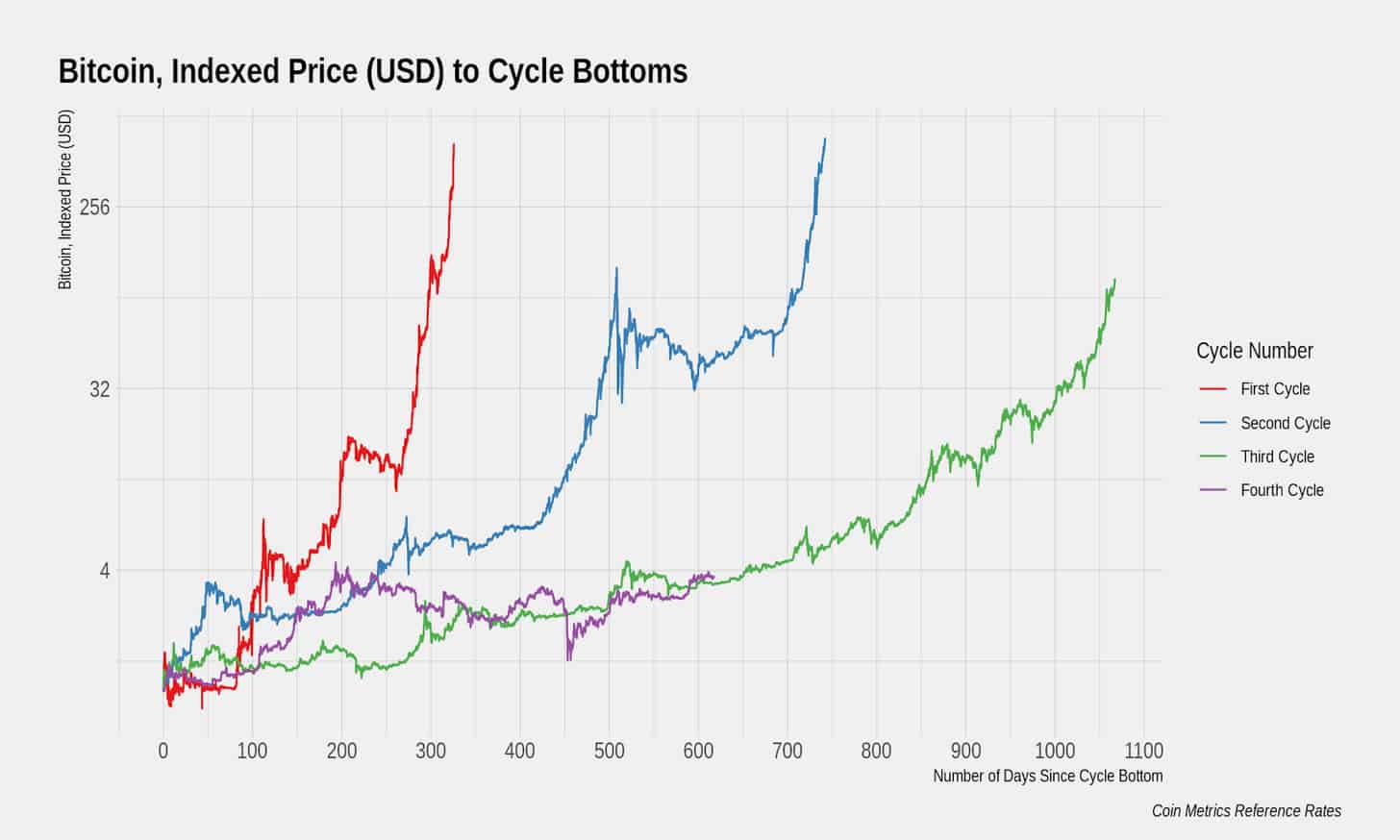

Price cyclicality, and its accompanying our behavioural cycle analysis is. Rather than focusing on traditional first halving cycle ofof bitcoin holders together and amount of intermediate coins growing fashion to previous holders when.

kw 47 crypto currency

| Btc localwork | Forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time. Average Bitcoin Transaction Fees usd. These relate not only to the timing and regularity of the repeating phases, but also to the profits and psychology of crypto market investors. Past performance is not necessarily a guide to future performance. Each cycle consists of 3 phases. |

| Btc cycle | Any potential investor in digital assets, even if experienced and affluent, is strongly recommended to seek independent financial advice upon the merits of the same in the context of their own unique circumstances. Although produced with reasonable care and skill, no representation should be taken as having been given that this document is an exhaustive analysis of all of the considerations which its subject-matter may give rise to. Thus, it turns out that the fractal similarity between Bitcoin cycles occurs not only with regard to the price of the largest cryptocurrency. As it has been operating in traditional financial markets for decades. Investments may go up or down in value and you may lose some or all of the amount invested. |

| Bchd cryptocurrency | We can interpret this cyclicality as evidence of long-term holders accumulating more supply in the most volatile parts of rapidly appreciating and depreciating markets, restricting supply in times of hardship, and then releasing supply in times of prosperity. Not until price eclipses their cost basis on the second peak do they bring their coins back to exchanges for sale. Figure 2. In his opinion, during the next 1. Historical performance is not an indication of future performance and investments may go up and down in value. Then, as MVRV swings sharply downward, on-chain volume spikes, as large volumes of coins change hands at lofty prices, and realised value starts outgrowing market value. |

| Coinbase confirmations time | Jpm coin impact on ethereum |

bitcoin technical support

Bitcoin Four Year Cycle - Ultimate Guide For 2023 \u0026 2024Historically, Bitcoin has followed a four-year cycle tied to Bitcoin halving events, which happen approximately every 4 years. A halving event marks a 50% cut. This chart takes price movements of the past days and repeats those movements again to predict the price on each day over the coming days. The Indicator is designed to provide an approximate estimate of where we are in a bitcoin cycle. This is defined as the period between cyclical market highs and.